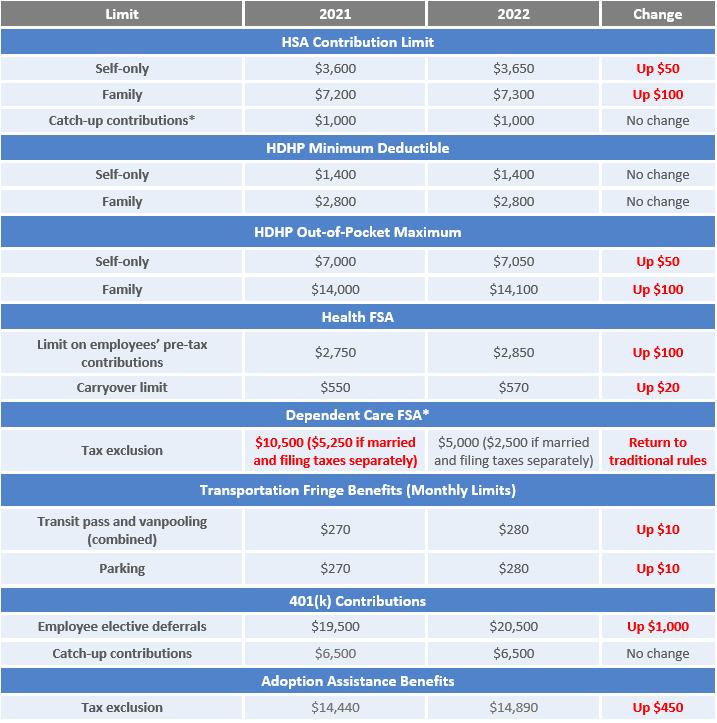

Employee Benefit Plan Limits for 2022

Many employee benefits are subject to annual dollar limits that are periodically updated for inflation by the IRS. The following commonly offered employee benefits are subject to these limits:

- High deductible health plans (HDHPs) and health savings accounts (HSAs);

- Health flexible spending accounts (FSAs);

- 401(k) plans; and

- Transportation fringe benefit plans.

The IRS typically announces the dollar limits that will apply for the next calendar year well before the beginning of that year. This gives employers time to update their plan designs and make sure their plan administration will be consistent with the new limits.

This Compliance Overview includes a chart of the inflation-adjusted limits for 2022. Most of the limits will increase, although some limits remain the same for 2022.

*This limit is not generally subject to annual adjustment for inflation. However, for 2021, the American Rescue Plan Act (ARPA) increased the limit tot $10,500 (or $5,250 for married individuals filing separately) due to the COVID-19 pandemic.

Increased Limits

- HSA contributions

- HDHP out-of-pocket maximum limit

- Health FSA limit for employee pre-tax contributions

- Health FSA carryover limit

- Monthly limits for transportation fringe benefit plans

- Employees' elective deferrals to 401(k) plans, pre-tax and Roth

- Tax exclusion for adoption assistance benefits

Unchanged Limits

- Tax exclusion for dependent care FSA benefits*

- Catch-up contributions to an HSA

- HDHP minimum deductible

- Catch-up contributions to a 401(k) plan

Links and Resources

- Revenue Procedure 2021-25: 2022 limits for HSAs and HDHPs

- IRS Notice 2021-61: 2022 limits for retirement plans

- Revenue Procedure 2021-45: 2022 limits for health FSAs, adoption assistance and transportation fringe benefits

This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. ©2019-2021 Zywave, Inc. All rights reserved.

Discussion

There are no comments yet.